A study from the University of Massachusetts Amherst found that the top 10% earners in the U.S. account for 40% of the country’s greenhouse gas emissions, with income from financial investments playing a significant role in these emissions. The research suggests focusing on taxing income and shareholders, rather than consumption, to incentivize the wealthy to adopt eco-friendly practices.

Recent research from the University of Massachusetts Amherst establishes the first connection between U.S. household income and emissions, highlighting investment as a major driver behind emissions inequality.

New research conducted by the University of Massachusetts Amherst indicates that the richest 10% of Americans account for 40% of the country’s total greenhouse gas emissions. The study, published in the journal PLOS Climate, establishes a connection between income, particularly income stemming from financial investments, and the emissions produced to generate that income.

The researchers recommend that in order to equitably achieve the objective of limiting global temperature rise to 1.5 C, policymakers adopt taxes focused on shareholders and the carbon intensity of investment incomes.

Scientists and environmentalists have long known that consumption—the amount and kind of food we eat, the vehicles we drive, and all the stuff we buy—is closely linked to greenhouse gas emissions. Traditional environmental policy has then sought to either limit consumption or guide it into more environmentally friendly avenues: replacing red meat with plant-based diets or swapping a gas-guzzler for an electric vehicle.

“But,” says Jared Starr, a sustainability scientist at UMass Amherst and the lead author of the new study, “consumption-based approaches to limiting greenhouse gas emissions are regressive. They disproportionately punish the poor while having little impact on the extremely wealthy, who tend to save and invest a large share of their income. Consumption-based approaches miss something important: carbon pollution generates income, but when that income is reinvested into stocks, rather than spent on necessities, it isn’t subject to a consumption-based carbon tax.”

“What happens,” Starr asks, “when we focus on how emissions create income, rather than how they enable consumption?”

An answer to that seemingly simple question, however, is fraught with difficulty, because though it’s relatively easy to capture a snapshot of wages and salaries—the main sources of income for 90% of Americans—it has been very difficult to get a sense of the investment income that makes up a large source of the richest Americans’ wealth.

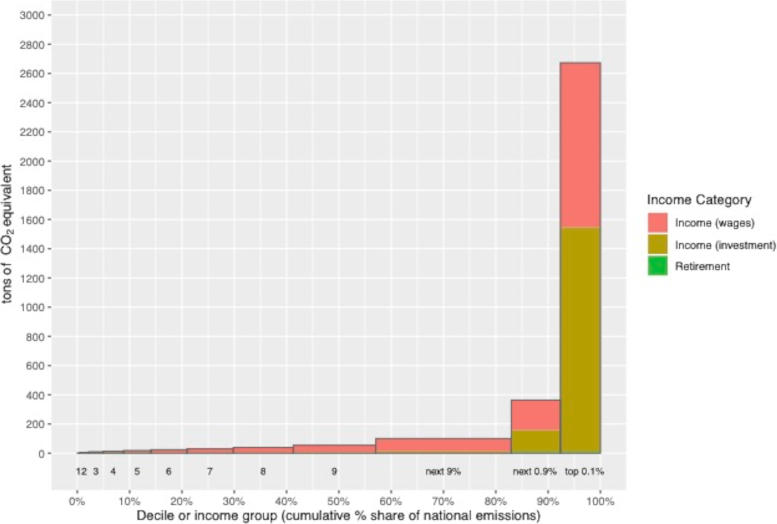

Mean household tons of CO2 equivalent emissions (2019) per income group under the pre-tax supplier framework. The width of each income group, on the x-axis, corresponds with each group’s share of national emissions. Credit: Jared Starr

To solve this problem, Starr and his colleagues looked at 30 years’ worth of data, drawing first on a database containing over 2.8 billion inter-sectoral financial transfers and following the flow of carbon and income through these transactions. This allowed them to calculate two different values: supplier-based and producer-based greenhouse gas emissions of income.

Supplier-based emissions are those created by industries that supply fossil fuels to the economy. For instance, the operational emissions released by fossil fuel companies are actually quite low, but they make enormous profits by selling oil to others who will burn it.

Producer-based emissions are those directly released by the operation of the business itself—like a coal-fired power plant.

With these two figures in hand, Starr and his co-authors then linked their emissions data with another database containing detailed demographic and income data for over 5 million Americans. This database parses out income sources differentiating active income—the wages or salaries earned through employment—from the passively generated investment income.

Not only did the team find that over 40% of U.S. emissions were attributable to the income flows of the top 10%, but they also discovered that the top 1% of earners alone generate 15 – 17% of the nation’s emissions. In general, white, non-Hispanic households had the highest emission-linked income, and Black households had the lowest. Emissions tended to increase with age, peaking in the 45–54 age group, before declining.

The team also identified “super emitters” with extremely high emissions intensity. These are almost exclusively among the top 0.1% of households, which are overrepresented in the fields of finance, real estate, and insurance, manufacturing, and mining and quarrying.

“This research gives us insight into the way that income and investments obscure emissions responsibility,” says Starr. “For example, 15 days of income for a top 0.1% household generates as much carbon pollution as a lifetime of income for a household in the bottom 10%. An income-based lens helps us focus on exactly who is profiting the most from climate-changing carbon pollution, and design policies to shift their behavior.”

In particular, Starr and his colleagues point to income and shareholder-based taxation—rather than taxing consumables.

“In this way,” says Starr, “we could really incentivize the Americans who are driving and profiting the most from climate change to decarbonize their industries and investments. It’s divestment through self-interest, rather than altruism. Imagine how quickly corporate executives, board members, and large shareholders would decarbonize their industries if we made it in their financial interest to do so. The tax revenue gained could help the nation invest substantially in decarbonization efforts.”

Reference: “Income-based U.S. household carbon footprints (1990–2019) offer new insights on emissions inequality and climate finance” by Jared Starr, Craig Nicolson, Michael Ash, Ezra M. Markowitz, and Daniel Moran, 17 August 2023, PLOS Climate.

DOI: 10.1371/journal.pclm.0000190

The American populist rightwing has said this for years, correctly. Take just a few people who travel the world lecturing you to stop travelling and stop bathing and only eat bugs; their emissions in a day will be more than the yearly emissions of the towns of everyone reading this combined.

“Traditional environmental policy…:replacing red meat with plant-based diets or swapping a gas-guzzler for an electric vehicle.” is non-traditional and recent, but part of how environmentalism lost the traditionally conservation-focused rightwing worldwide (i.e. conservative). If individual health is no concern, why not replace plant-based diets with starvation? Electric vehicles burn coal elsewhere, with the added burden of charging and towing awful heavy flammable temporary environmentally-unfriendly batteries everywhere. The authoritarian aspect of counter-productive policy has people fleeing from environmentalism.

I’m glad an academic study has come to similar conclusions. My concern is the modern populist leftwing will offer the solution that these people’s money must be taken away. “Imagine how quickly corporate executives, board members, and large shareholders would decarbonize their industries if we made it in their financial interest to do so. The tax revenue gained…” is targeting the bourgeoisie for the proletariat through the state limiting everyone’s freedom. A glance at 20th century history shows class conflict and government expansion do not help the environment.

This is a deeply political article, which is probably the wrong approach. Science and technology (daily) are likely the ways out of the problem.

“Take just a few people who travel the world lecturing you to stop travelling and stop bathing and only eat bugs; their emissions in a day will be more than the yearly emissions of the towns of everyone reading this combined.”

But these people live in the very towns you mentioned, so that must be false. Most countries have a certain percentage of power from non CO2 emitting sources, so EVs emitt less CO2 per mile, even including the CO2 produced from electricity generation. Note also that power plants are more efficient than ICE engines. The proportion of electricity generated from non-fossil fuels is increasing all the time. It’s probably simplest to tax CO2 emissions directly with say a 5% annually increasin tax, especially for international air travel and shipping; consumers and investors will automatically choose the cheapest/better performing options. Governments can choose how they spend the extra income.

BTW, the study outcome is obvious. It would be very surprising if the bottom 1% produced 10% of the CO2 emissions.

Cheers for the reasoning reply. I’ve a few points:

I doubt the top 0.1% of Americans are reading comments, and they generally live in cities. A class of billionaire townsfolk is unlikely, but we can exclude them if you’d like.

Consumers and investors in capitalist societies already choose the cheapest and most performant option, in other words the most efficient, and likely the most environmentally friendly. A tax does not increase efficiency, but inherently decreases it. Needing to make other options artificially less efficient for coersion is a signal that your desired choice is less efficient, and forcing people into it will make them resentful and anti-environmentalist. Giving a government more money will only increase its emissions, and it is by far the worst emitter in America. You paying more won’t decrease the travel and consumption you need to do for survival, and 5% tax won’t dissuade the ultra-wealthy from using their private jets if they’d even notice it at all.

The bottom 1% is already on the margins of survival, less able to make the emissions needed for it. A 5% carbon tax acts like a sales tax, not collecting much money from them but also taking a large percentage of their total income. Even if the tax is limited to corporations, consumers still pay that cost. Countries like Canada have tried a carbon tax with a yearly refund for lower-income brackets, only creating a massive inefficient bureaucracy and a cost-of-living crisis, needing to fake the refund numbers.

I disagree on the electric vs. gasoline analysis, considering the high and increasing efficiency of gasoline engines, the terrible efficiency of the dozen electricity conversions necessary, battery production, brief electric vehicle lifespan, tiny fraction of renewable-generated electricity and the carbon footprint needed to create and maintain and replace those solar panels and turbines, etc etc, but we’ve discussed that before.